When it comes to auto insurance, it can be difficult to make sense of all the technical terms you come across. For example, a lot of people wonder what the difference is between deductible and deductible waiver. In today’s post, we provide an answer.

What Is the Difference Between Deductible and Deductible Waiver?

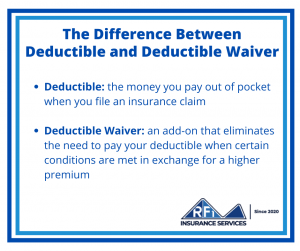

Here’s a quick recap of the difference between deductible and deductible waiver.

Deductible is the money you pay out of pocket when you file an insurance claim. Deductible waiver, on the other hand, is a component of an insurance policy that eliminates the need to pay your deductible when certain conditions are met in exchange for a higher premium.

Now let’s take a closer look at these two insurance terms and the role they play in auto insurance.

What Is Deductible?

In insurance, “deductible” refers to the amount of money you agree to pay out of pocket when you file an insurance claim.

So, for example, if you have a deductible of $500 and your car sustains damage for $2,500, you will have to pay the first $500 before your insurance company steps in to pay the remaining $2,000.

As a rule of thumb, the higher your deductible, the lower your premium will be.

Choosing a high deductible is a reliable way to lower your insurance rates, but you must be careful. If your deductible is too high, you run the risk of not being able to pay it when you need to file an insurance claim.

What Is a Deductible Waiver?

A deductible waiver is an optional add-on to your auto insurance policy that waives the requirement to pay your deductible before the insurance company covers the rest of the claim.

The most common type of waiver is the Collision Deductible Waiver, or CDW, for short.

A Collision Deductible Waiver eliminates the deductible requirement if you’re hit by an uninsured driver.

The way Collision Deductible Waivers work varies from state to state. For example, California is one of the few states where CDWs apply even in the case of a hit-and-run incident. However, you are still required to identify the driver or car that hit you.

To learn more about Collision Deductible Waiver, check out our previous post, “Collision Deductible Waiver vs Uninsured Motorist Property Damage: What Is the Difference?”

RF1 Insurance Services: Auto Insurance in Southern California

Looking for auto insurance you can rely on? At RF1 Insurance, we work with some of the world’s most trusted insurance companies, including Safeco, Guard, Stillwater, National General Premier, Aegis, and the California FAIR Plan.

Contact us today by email (info@RF1ins.com), telephone (909-359-2067), or social media (Facebook, Twitter, LinkedIn) for a free quote or to learn more about a full range of insurance solutions.